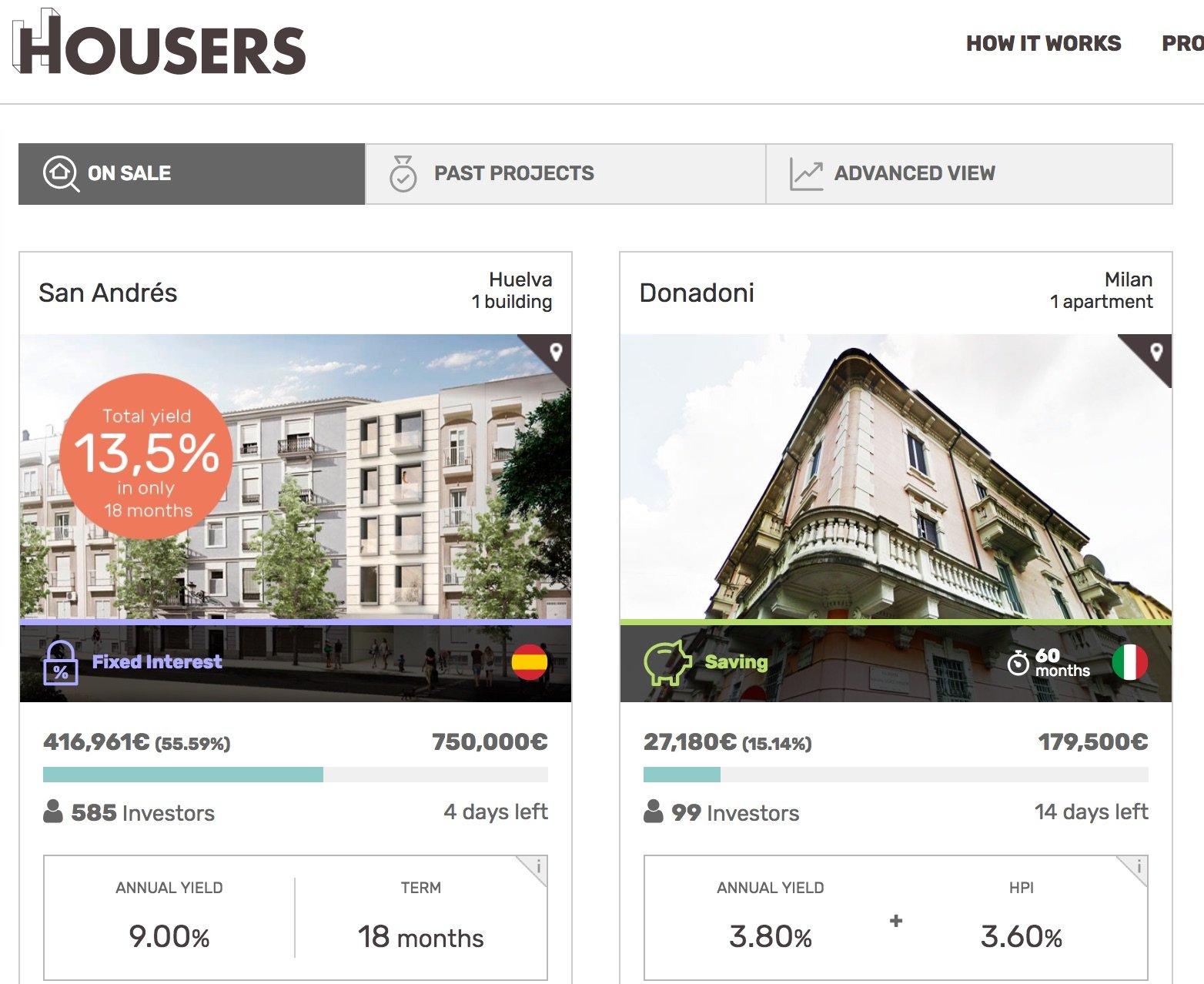

Housers – P2P lending platform from Spain.

The good

exposure in Spanish, Portugese and Italian real estate market.

The Bad

- Customer support’s english level is poor. My questions about the platform were not answered either by Marketing department either by customer support. UPDATE: When i wrote a personal message to the CEO about the problem, I got the message from the marketing department that they will call me – guess what – no one called me 🙂

- The registration for EU company as an investor is challenging.

- It is not clear who are the owners of the funded projects, because some projects are given to the platform from third parties and some of them are their own.

- Company is very secretive in their CrowdCube equity raising (see the discussions part where they answer many questions “we can not answer that because of the confidentiality clause”

Housers has secondary market which is good, but the prices are fixed so entry/exit chances are limited even though you want to bid/ask lower/higher.

Do the projects have first rank mortgage?

Housers reply:

Saving opportunitites. Yes, unless otherwise stated

Investment opportunitities. No, usually second after the bank. Bank is less that 20%

Fixed rate opportunities: Case by case

In nay case, the loan has more privileges than being a shareholder

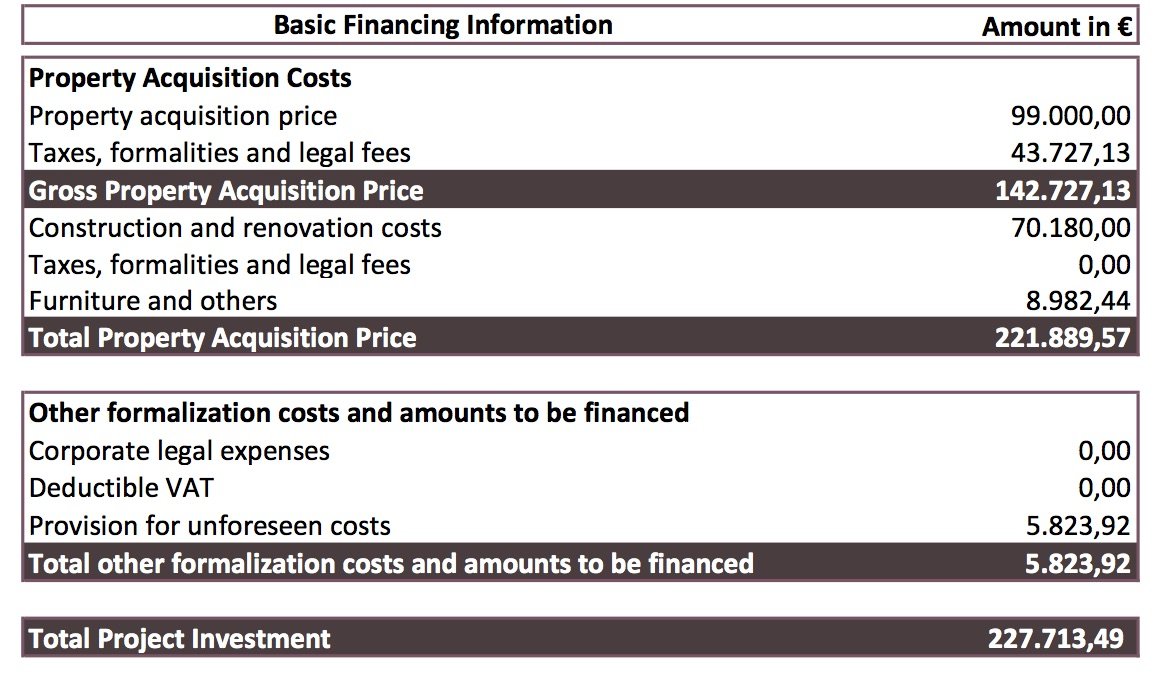

Example project in Valencia.

2017 last week of August i went to Valencia to look for real estate investment. Having done research on Idealista I think I knew the market at some level so I could value example project provided by Housers.

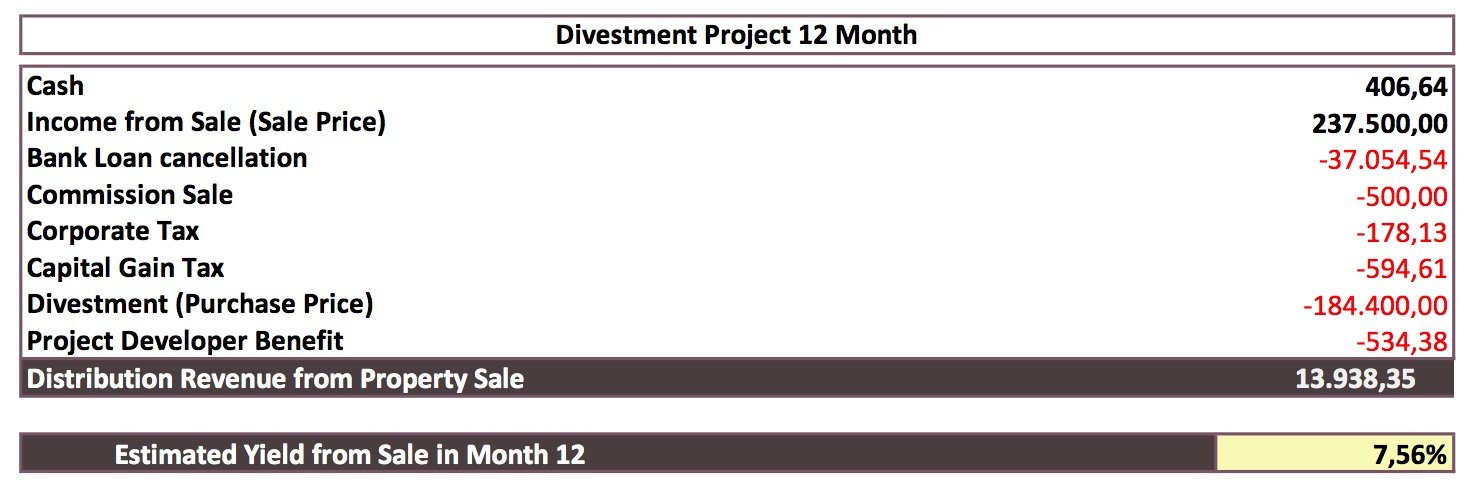

The advertised project Joaquin Sorolla with expected return of 7.61%

Property Area (m2) 114, 2 bedroom, 1 bathroom

Elevator – No (second floor that starts with ground floor)

===

2018 February 20

I came back to the idea investing in this platform. Saw few interesting deals and wrote a simple question “where can i find collateral and LTV values in investment offers?”

so the answer is this:

the objects with collateral have the house symbol. And the LTV value you have to dig in the documents and make a research as it is hidden 🙂